A transition to retirement (TTR) pension is a financial strategy that may allow you to access your superannuation before you stop working completely. It can act as a financial bridge, letting you draw a regular income from your super once you’ve reached your 'preservation age', while you are still employed.

This approach is generally designed to offer flexibility in the final years of your working life.

What exactly is a transition to retirement pension?

Think of your superannuation as a long-term savings account that is generally 'locked' until retirement. A transition to retirement pension, often shortened to TRIS for transition to retirement income stream, may provide a way to access some of those funds. It allows you to start drawing a regular income from that account without having to leave your job.

This can provide an option to ease into retirement under your own terms.

Generally, people use a TTR pension for one of two main reasons.

To supplement your income

A common use for a TTR pension is to supplement your income if you decide to reduce your work hours. For example, if you're considering moving from five days a week down to three, your take-home pay will likely decrease. A TTR pension may help to fill that gap, allowing you to adjust your work-life balance without a significant change to your income.

To potentially boost your super

Another approach, which can be more complex, often involves salary sacrificing. In this scenario, you might continue working full-time but arrange to contribute extra pre-tax dollars into your super. The TTR income stream then replaces the take-home pay you've "sacrificed," so your day-to-day cash flow may remain similar.

This strategy can be a tax-effective way to add to your super, but it's an area with many variables. You can learn more about the general mechanics by reading our guide on understanding your superannuation through planning.

A TTR pension offers a way to restructure your finances as you approach retirement, providing options that may not otherwise be available. It is designed to provide flexibility, whether that means winding down your work commitments or making a final effort to grow your retirement savings.

This flexibility is an important consideration for many. In Australia, a TRIS allows you to access up to 10% of your super balance each year once you're over your preservation age (which is 60 for many people). With the average retirement age being 57.3 years according to recent data, strategies like this can play a role in financial planning. You can see more on these trends in the latest retirement intentions report from the ABS.

Key features of a TTR pension at a glance

To make things clearer, here’s a quick summary of what a TTR pension generally involves.

| Feature | Description |

|---|---|

| Eligibility | You must have reached your superannuation preservation age. |

| Work Status | You can be working full-time, part-time, or casually. |

| Access to Super | You can access your super as an income stream, not a lump sum. |

| Annual Drawdown Limits | You must draw a minimum of 4% and a maximum of 10% of your account balance each financial year. |

| Tax on Earnings | Investment earnings within the TTR pension are generally taxed at up to 15%. |

| Tax on Income Payments | If you're aged 60 or over, income payments are generally tax-free. If you're under 60, they may be taxed at your marginal rate with a 15% tax offset. |

This table provides a simple snapshot, but the potential effectiveness of a TTR strategy comes from understanding how these rules apply to your specific situation.

How a TTR pension works in practice

So, how does a transition to retirement (TTR) pension actually work on a day-to-day level?

Think of it this way: instead of your super being a single locked pot of money, a TTR lets you notionally split it into two. You move a portion of your super savings from your main account into a new pension account. This new account is specifically designed to pay you a regular income, even while you’re still working.

You would typically request this from your super fund. They would then shift the amount you’ve decided on from your accumulation account (the one your employer pays into) over to a new pension account. From there, the payments can start flowing into your bank account.

The two-account structure

It may help to imagine your super now has two distinct jobs, managed by two separate accounts.

- Your Accumulation Account: This is your standard account. It continues receiving your employer’s superannuation guarantee payments and any personal contributions you make. It stays invested, continuing to grow for the long term.

- Your Pension Account: This is the new account from which you’ll draw an income. While it’s also invested and can earn returns, its balance will decrease as you receive your regular payments.

This two-account setup allows you to continue building your retirement savings in one account while drawing a supplementary income from the other. It’s a parallel system designed for the pre-retirement period.

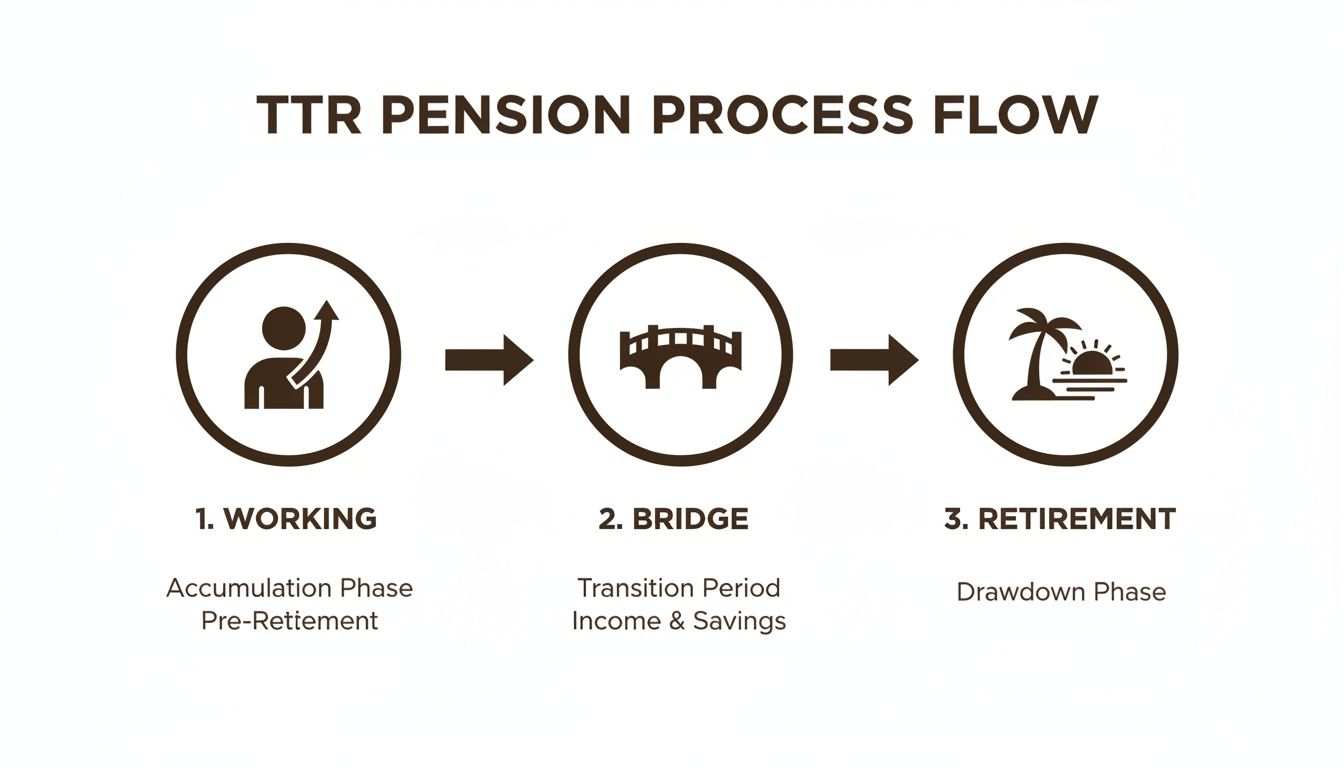

This flowchart shows how a TTR pension can act as a bridge between your working life and full retirement.

As you can see, the TTR strategy is designed for that interim phase, giving you access to some super while you’re still earning an income, before you finally stop working.

The rules on your income payments

A TTR pension is subject to specific rules. The government has put clear guidelines in place to ensure the money is used to supplement income, not to withdraw a large lump sum before retirement.

You’re required to draw a minimum amount each year, but you're also capped at a maximum. This is designed to help your super last for your actual retirement.

Here’s how the payment rules generally break down:

- Minimum Annual Payment: You must withdraw at least 4% of your pension account balance each financial year. This is calculated based on your balance on 1 July.

- Maximum Annual Payment: You cannot take out more than 10% of your pension account balance in a financial year. This cap is the key difference between a TTR pension and a regular retirement pension.

Let’s use a simple, general example. If you start a TTR pension with $300,000, you would need to draw an income between $12,000 (4%) and $30,000 (10%) for that year. Most funds allow you to choose how often you get paid—fortnightly, monthly, or quarterly—so you can align it with your salary or other bills.

The eligibility rules you need to know

Before you can commence a transition to retirement pension, there are a few criteria you need to meet. These rules are put in place by the government to ensure this early access to super is used as intended: to supplement your income as you ease out of full-time work, not as a way to cash out early.

The first and most important requirement is reaching your preservation age.

Understanding your preservation age

Your preservation age is the specific age at which you can legally start accessing your superannuation savings. It’s not the same for everyone; it depends on when you were born. This is the age at which the government allows you to start accessing your retirement funds, even while you’re still working.

For anyone born on or after 1 July 1964, this age is 60. If you were born before that, it starts at 55 and scales up.

Here’s a table to find yours:

| Date of Birth | Preservation Age |

|---|---|

| Before 1 July 1960 | 55 |

| 1 July 1960 – 30 June 1961 | 56 |

| 1 July 1961 – 30 June 1962 | 57 |

| 1 July 1962 – 30 June 1963 | 58 |

| 1 July 1963 – 30 June 1964 | 59 |

| On or after 1 July 1964 | 60 |

Reaching this age is the non-negotiable first step. If you haven't reached it, a TTR pension is not yet an option for you.

Other key eligibility conditions

Once you've cleared the preservation age hurdle, there are a couple of other conditions to keep in mind.

- You must still be working: This is a key requirement. A TTR pension is designed specifically for people still in the workforce, either full-time or part-time. You cannot have already fully retired.

- Your super fund has to offer it: Most large, well-known super funds will have a TTR option, but it is not guaranteed. It’s always a good idea to check directly with your fund to make sure it’s a product they provide.

- The pension is non-commutable: This sounds technical, but it’s a crucial rule. It means you cannot take your money out as a lump sum from the TTR account. The capital generally remains preserved until you meet a "condition of release," such as retiring permanently or turning 65.

This "non-commutable" rule reinforces the purpose of a TTR strategy—it's designed to provide an income stream, not a large cash withdrawal.

A TTR pension is generally only accessible once you meet a specific age and are still working. It provides an income stream from your super, but your capital remains preserved until you meet a full condition of release.

Understanding these rules is the best way to determine if a TTR strategy could be suitable for you. Of course, the amount you can draw down will depend on what you've saved over the years. For a better sense of what goes into building that balance, check out our guide on what influences the size of your super. Knowing the rules upfront puts you in a stronger position to plan your next steps.

Exploring common TTR strategies and potential benefits

A transition to retirement (TTR) pension is a tool. Like any tool, its value depends on how it is used. Most people leverage a TTR strategy in one of two ways, each designed for a different goal as they approach their final working years.

Let's break down these common approaches. Seeing how they work in practice can help you consider if a TTR pension aligns with your own retirement plans.

Strategy 1: easing into retirement by reducing work hours

The most common reason people start a TTR pension is to supplement their income after cutting back on work. It can be an option for those who are ready for a better work-life balance but are not in a financial position to stop working altogether.

Imagine you decide to reduce from a five-day week to three. While this might be good for your lifestyle, it could also mean a 40% reduction in salary, which could impact the household budget.

This is where the TTR pension can be useful. You can start drawing a regular income from your super to bridge that financial gap. The idea is to maintain your lifestyle and meet financial commitments without needing to draw on other savings.

This approach essentially lets you supplement your reduced pay with your own super money, potentially funding a gradual and more comfortable transition into full retirement.

It's a practical way to test the waters of retirement, reclaim some personal time, and lower stress levels, all while keeping your finances on a more stable footing.

Strategy 2: boosting your super with salary sacrificing

The second strategy is more involved but can be effective in certain circumstances. It involves pairing a TTR pension with salary sacrificing to potentially give your super balance a significant boost before you retire, often in a tax-effective way.

Here’s the basic idea of how it can work:

- Boost Your Super Contributions: First, you arrange with your employer to "sacrifice" a portion of your pre-tax salary and have it paid directly into your super account. Because this is a concessional contribution, it lowers your taxable income, which can mean you pay less income tax.

- Start Your TTR Pension: Next, you start a TTR pension and draw an income stream to replace the take-home pay you just sacrificed. The goal here is to keep your net cash flow broadly the same.

- The Potential Outcome: The result may be that you've moved more of your money into the lower-tax superannuation environment to grow, all while your day-to-day income has remained similar.

Let's walk through a simple, hypothetical example to make this clearer.

A General Example (Not Personal Advice)

Meet Sarah. She’s 62 and earns $100,000 a year. She decides to salary sacrifice $25,000 of her pre-tax income into her super. This immediately drops her taxable income to $75,000, potentially saving her an amount on her income tax bill.

To replace this "lost" income, she starts a TTR pension and draws $20,000 for the year. Because she's over 60, these pension payments are tax-free. While her overall cash flow is slightly lower in this example, she has successfully moved a large sum into her super fund to continue growing for her future.

This strategy is not a simple set-and-forget. It requires careful calculation to ensure you stay within your contribution caps and that the tax outcomes work for your specific situation. But for some, it can be an effective way to accelerate their retirement savings in their final years of work.

Potential pros and cons of a TTR pension

A TTR pension can be a useful strategy, but it's not without its trade-offs. It's important to weigh up both sides before proceeding.

Here's a balanced look at the key advantages and disadvantages to consider.

| Potential Advantages | Potential Disadvantages and Considerations |

|---|---|

| Maintain your lifestyle while working fewer hours by supplementing your income. | Your super balance will be drawn down, potentially leaving you with less in retirement. |

| Potentially save on tax by combining a TTR with a salary sacrifice strategy. | The strategy can be complex to set up and manage correctly. |

| Keep your super invested and growing while accessing a portion of it. | Investment earnings within a TTR pension are taxed at up to 15%. |

| Flexibility to choose your payment amount within the 4% to 10% limits. | There is no access to lump-sum withdrawals until you meet a condition of release. |

Ultimately, whether the pros outweigh the cons depends entirely on your personal financial situation, your goals for retirement, and how close you are to finishing work for good.

Tax and Centrelink considerations

Starting a transition to retirement (TTR) pension does not happen in isolation. It connects to your overall financial life, and that means you need to understand how it affects your tax and any government benefits you might receive, such as the Age Pension.

Understanding these interactions is important. The rules can be detailed, and what works for one person might not work for another. Let's break down what you need to know.

How is TTR pension income taxed?

One of the most common questions people have is about tax on the income they draw down. The rules are reasonably straightforward, and it all depends on a key age milestone.

Your age is the primary factor here:

Aged 60 or over: This is a key age. Any income you take from your TTR pension is generally tax-free. This is a significant feature and a reason why TTR strategies are popular for people in their 60s.

Under age 60: If you start your TTR earlier, the payments you receive are generally taxable. However, you will usually receive a 15% tax offset on the taxable portion of your income, which helps to reduce the tax payable.

Of course, these are general rules. Your final tax outcome will always depend on your total income from all sources.

Tax on investment earnings inside your TTR

Now for the money your super is earning. While you’re in the TTR phase and still working, the investment earnings generated inside your pension account are taxed.

The earnings on assets backing your TTR income stream are taxed at a rate of up to 15%. This is the same tax rate that generally applies to your regular super accumulation account.

This is a critical point of difference from a standard retirement pension. Once you fully retire and move to a retirement income stream, the investment earnings on the money funding your pension generally become tax-free.

A TTR pension lets you access your super early, but the tax on its investment earnings remains the same as your regular super account until you fully retire.

So, while the income you draw might be tax-free (if you're over 60), the investments working in the background are still generating earnings that are subject to tax.

How Centrelink assesses a TTR pension

If you think you might be eligible for Centrelink support like the Age Pension, it is important to know how a TTR is viewed. Centrelink uses both an income test and an assets test, and your TTR pension is generally counted under both.

Here’s a quick rundown of how they assess it:

Assets Test: This is straightforward. The entire balance of your TTR pension account is counted as an asset.

Income Test: This is where it gets more complex. Centrelink doesn't look at the actual payments you're drawing from your TTR. Instead, they use a system called 'deeming', where they assume your financial assets earn a set rate of income, regardless of what they actually earn.

This 'deemed' income is then added to any other income you have when Centrelink calculates your entitlements.

These assessments can directly affect the amount of Age Pension you might receive. Given the complexities, seeking professional advice is often a prudent step to understand exactly how the rules will apply to your specific situation.

Is a transition to retirement pension right for you?

Understanding the mechanics of a transition to retirement (TTR) pension is one part of the process. The real challenge is determining if it's the right move for you. This is not a one-size-fits-all solution; its suitability depends on your personal goals, your financial situation, and where you are on your journey to retirement.

Instead of providing definitive answers, let's walk through some key questions. Think of this as a way to self-assess whether a TTR strategy aligns with what you want to achieve.

Questions to ask yourself

Before commencing a TTR pension, it’s worthwhile to take an honest look at your current life and future plans. Working through these questions can bring clarity and help you decide on your next steps. It's a great starting point, and you can dive deeper by exploring when is the best time to start thinking about retirement.

Let’s start with the most important one.

What am I really trying to achieve? Is the main goal to cut back on work hours without a significant impact on your pay? Or are you more focused on using a tax-effective strategy to give your super a final boost before you stop working? Your "why" is central to the decision.

What does my overall financial picture look like? Take stock of everything. Do you have other savings or income streams you can rely on? You need to see the whole picture before you start making changes, especially when it involves your super.

How do I feel about investment risk? It’s important to remember that the money in your TTR pension account is still invested in financial markets. That means its value will fluctuate. You need to be comfortable with the idea that your balance could go down as well as up.

How far away is full retirement? Your timeline makes a big difference. A TTR might look very different if you’re five years away from stopping work versus just a year or two.

Taking the time to think through these points builds a solid foundation for making an informed decision. The aim is to move forward with a clear understanding, feeling confident you've looked at it from every angle.

Making an informed decision

Simply thinking through these questions is a powerful first step. It helps you see if the potential upsides of a TTR—like more flexibility or certain tax benefits—are a good match for your life right now.

If you find your answers point towards the common reasons people use a TTR, then it may be worth a closer look. For most people, this is the point where seeking personalised advice becomes very useful.

A qualified financial adviser can run the numbers with you, model a few different scenarios, and explain exactly what it means for your tax and any potential Centrelink benefits. They can provide a clear, structured assessment based on your unique situation, so you can make a choice with confidence.

Your TTR pension questions, answered

Even after you understand the basics of a transition to retirement (TTR) pension, it’s normal to have questions about the details. This strategy has some very specific rules that can feel confusing at first.

To help clarify, we’ve put together some straightforward answers to the questions we hear most often about TTR pensions.

Can I take a lump sum from my TTR pension?

This is a common question, and the short answer is generally no. A TTR pension has a special rule that makes it ‘non-commutable’. That’s just a technical way of saying you can’t cash out your capital as a lump sum while you're still working and under 65.

The purpose of a TTR is to provide a steady income supplement, not to unlock a large portion of your super early.

Full, unrestricted access to your super—including the ability to take lump sums—only comes when you meet a ‘condition of release’. The most common ones are:

- Turning 65 (regardless of whether you are still working).

- Permanently retiring after you reach your preservation age.

- Leaving a job after you turn 60.

Once you meet one of those conditions, the specific TTR rules, like the 10% maximum withdrawal limit, fall away.

What happens to my TTR if I stop working?

When you decide to stop working for good, your TTR pension doesn’t just disappear—it changes. For most people, it will automatically convert into a standard account-based pension, also known as a retirement income stream.

This is an important moment because the rules become more flexible.

The moment you fully retire, the 10% maximum withdrawal cap on your pension is removed. You are then free to access as much of your super as you need—including lump sums—as long as you meet the government's minimum annual withdrawal rules.

Your super effectively transitions with you. It moves from being a tool to supplement your work income to become a primary source of funding in retirement, giving you much more control over your money.

How does a TTR pension affect the Age Pension?

This is a critical piece of the puzzle for many people. Centrelink looks at both your assets and your income to determine if you’re eligible for the Age Pension, and your TTR pension is generally counted in both tests.

Here’s a quick rundown of how Centrelink assesses it:

- The Assets Test: The entire balance of your TTR pension account is counted as an asset.

- The Income Test: This is where it gets more complex. Centrelink uses a system called 'deeming'. They don't look at what your investments actually earn or what you withdraw. Instead, they assume your financial assets (including your TTR) earn a set rate of income. This 'deemed' amount is what they use in their calculations.

How this impacts your potential Age Pension payments depends entirely on your overall financial situation. Because the rules are complex and everyone's circumstances are different, this is one area where seeking professional financial advice is highly recommended.

Navigating superannuation and retirement can feel complex, but you don't have to do it alone. The information in this article is general in nature. At VTA Financial Planning, we offer clear, independent, and commission-free advice to help you feel confident about your future. If you'd like to discuss your transition to retirement options, we're here to help.